Chamber Members:

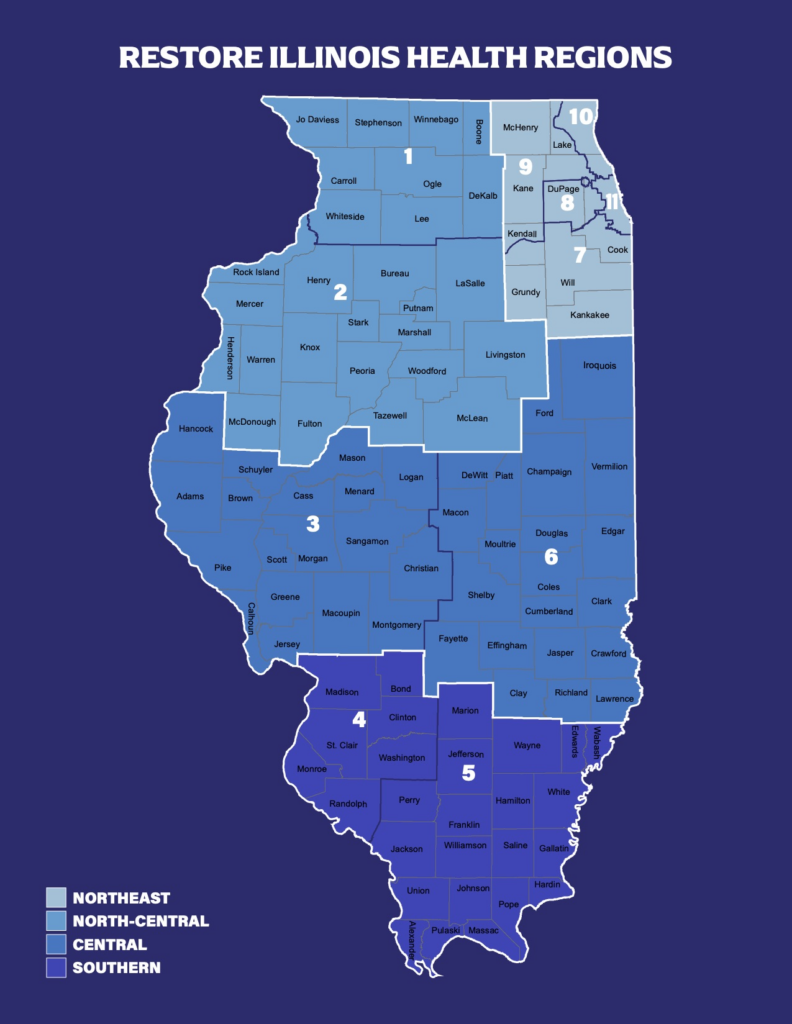

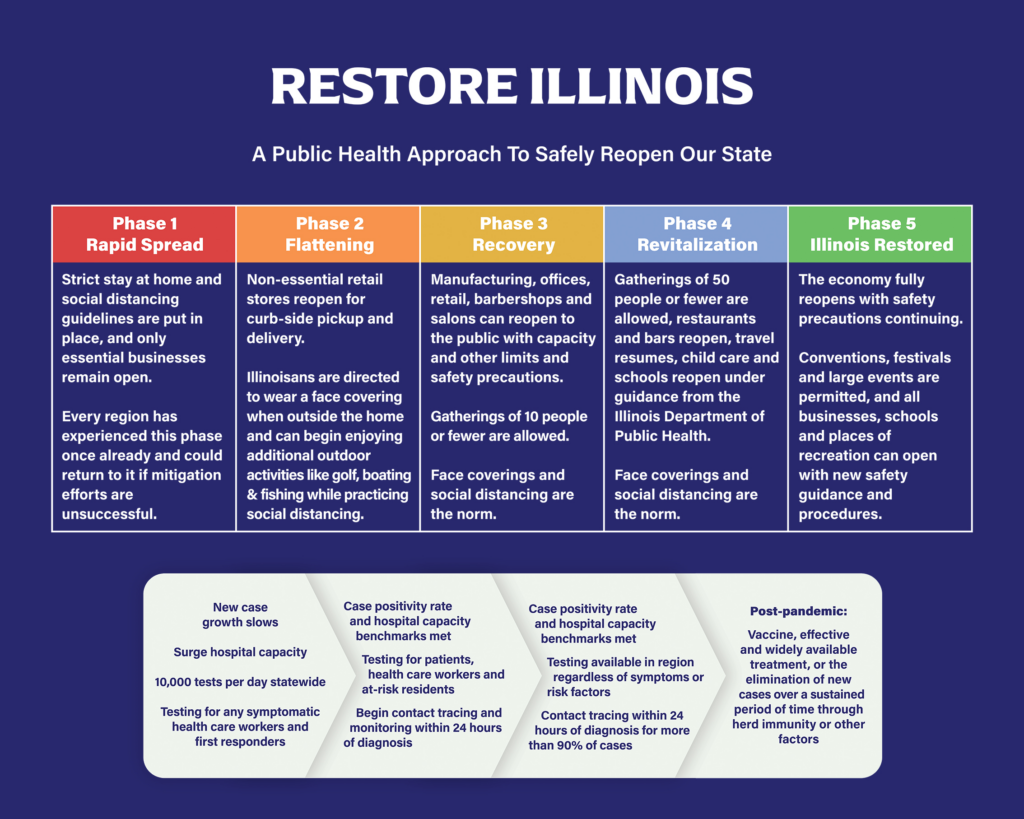

Big news today! Governor Pritzker has announced a reopening plan that identifies five phases and divides that state into four regions. Each phase has specific benchmarks that need to be achieved before advancing onto the next phase which will allow less restrictions. Each region can independently move through phases as well. The entire state is currently in phase 2. The Joliet region / Will County are part of the Northeast region along with Cook, Kankakee, Grundy, Kendall, Kane, McHenry, Lake, and DuPage counties. Here are the specifics for each phase:

- Phase 1 (Rapid Spread)

- Strict social guidelines

- Only essential businesses can opn

- Phase 2 (Flattening)

- Nonessential stores can reopen for curbside pickup

- Some outdoor activities like golf and fishing reopen

- Phase 3 (Recovery)

- Numbers need to be flat or declining

- Manufacturing, offices, stores, barbershops and salons to reopen with capacity limits. Gyms also could open outside and inside for one-on-one personal training

- Gatherings of 10 people would be allowed

- Face coverings and social distancing still apply

- Phase 4 (Revitalization)

- Numbers need to stay in decline

- Gatherings increased to 50 people

- Restaurants and bard could reopen for on-site service

- Childcare and schools could reopen with face coverings and social distancing still applied

- Phase 5 (Restored or Fully Reopened)

- Requires a vaccine or “highly effective treatment”

- Major events including conventions and festivals are allowed

Look here at the map and phases below

Yesterday, we made the announcement that the SBA’s EIDL loan program has closed indefinitely for all non-agricultural businesses. Today, we learned that those who had applied before the current online loan portal opened on 3/30/20 should have received an email and/or letter instructing them to “reapply” in the new portal. Those that applied through the original process would have an application number starting with 2 rather than 3. The purpose of this request was that the new streamlined process offers much more efficient underwriting and disbursement and would get the funds in the hands of those approved for loans more quickly.

Not all applicants “reapplied” and the SBA is intent on closing the loop to ensure those businesses have their loan applications processed as quickly as possible. We have been told that the EIDL application portal is available to those businesses that need to reapply in addition to agricultural enterprises. We have also been assured that these applicants will not lose their spot in the queue and their “reapplication” will be matched to the time and date of initial application. All that reapply should receive an updated application number beginning with the number “3”.

For questions and concerns, the SBA local office can be reached at (800) 659.2955 or you can email specifically for EIDL questions at disastercustomerservice@sba.gov.

The U.S. Small Business Administration has released updated numbers for the second round of the Paycheck Protection Program funding as of May 1: https://www.sba.gov/document/report–paycheck-protection-program-ppp-report?utm_medium=email&utm_source=govdelivery

Illinois has seen almost 160,000 loans worth $22 billion approved in this first week period. In one week, these numbers have surpassed the total first round of PPP funding showing just how large the need was. Thousands of loans continue to be processed on a daily basis

New legislation has been planned by Senate Minority Leader Chuck Schumer that would mandate new disclosure requirements for PPP and other lending programs. Daily and weekly public reporting would be required and broken down by geography, demographics, and industry. The data would need to be downloadable and would include the names of the entities and the loan or grant amounts. It also would need to detail whether the programs are reaching underserved communities.

We are hearing that Congress is giving consideration to pushing back the June 30th deadline to bring back employees if had laid off to qualify for PPP forgiveness now until the end of August. This is a welcome development as several companies have expressed their concern to be able to do this especially if there are not able to reopen until June 1 at the earliest. Hopefully, the next advancement will be to relook at the 75/25 percent split on payroll vs. non-payroll such as utilities, rent, etc. as that is not favorable for all situations.

California has been announced as the first state to borrow federal funds to replenish state unemployment insurance funds. They reportedly borrowed $348 million after receiving approval to tap up to $10 billion for this purpose through the end of July. Reports also show that Illinois has been approved for up to $12.6 billion in loans if needed, but the state has yet to access the borrowing program.

Illinois Chamber President & CEO, Todd Maisch, has shared his most recent Two Minute Drill video. In it, Maisch talks about both the public health crisis and the economic health crisis, the three R’s (responsible, rehiring, and reopening), and exposure, medical, product, and securities liability. You can watch here: https://www.youtube.com/watch?v=7MvEzgvPUMo&feature=youtu.be

State revenues dropped $2.74 billion last month compared with April 2019 according to a released report from the Illinois Commission on Government Forecasting & Accountability (COGFA). Gross personal income taxes fell a whopping $1.977 billion, or $1.678 billion on a net basis, while gross corporate income taxes dropped $482 million, or $377 million net. The decreases were fueled by effects of COVID-19, tax day deadline changes, and the phenomenally strong performance of income taxes in April 2019. Sales taxes, after holding up in March due to receipts in “the pipeline,” could not escape the economic shut down, as gross receipts dropped $143 million, or $146 million net. Several smaller revenue lines also experienced declines in April as other sources were down $15 million, both corporate franchise taxes and interest income were each off $12 million, cigarette tax fell $10 million, and vehicle use tax dipped $3 million. Lottery transfers dropped $21 million as ticket purchases were likely impacted by stay at home orders. View the full report here: http://cgfa.ilga.gov/Upload/0420revenue.pdf

Talks have resurfaced on a Chicago casino as a way to help close the revenue gap the state is facing. In order for this and many other proposals to move, lawmakers will need to return to Springfield. Supposedly, some staff are beginning to return in an extremely limited role to offices to begin the process of a return.

The Illinois Retail Merchants Association has invited our members to participate in a webinar on Thursday at 10 am regarding Unemployment Insurance. Dealing with issues related to unemployment insurance is an important topic so this webinar will give an overview of the current state of unemployment insurance and the important nuances employers should know. You can register here: https://register.gotowebinar.com/register/3270679162885815054

Finally, another reminder for some relief those may be looking for if they were unable to receive EIDL or PPP loans. The CARES Act permits any employer to defer payment of the employer portion of Social Security taxes regardless of whether the employer is affected by COVID-19. The statute does not impose any terms and conditions for the deferral and does have any employer size requirements. All employers are eligible to use the deferral. The deferral can apply to the employer Social Security tax payable at any time beginning as March 27, 2020 (date of enactment of the CARES Act), and ending before January 1, 2021. The deferral applies only to the employer portion of Social Security taxes. The deferral does not apply to the employer portion of Medicare taxes. The deferred employer Social Security taxes must be paid in two installments by the following dates (the “applicable dates”):

- 50% by December 31, 2021.

- Remaining 50% by December 31, 2022.

No interest or penalties apply to the deferred Social Security tax payments.

Stay well,

Joliet Region Chamber of Commerce & Industry Staff and Board of Directors

Mike Paone

Vice President – Government Affairs

Joliet Region Chamber of Commerce & Industry

815.727.5371 main

815.727.5373 direct